Condo Insurance in and around Colorado Springs

Townhome owners of Colorado Springs, State Farm has you covered.

State Farm can help you with condo insurance

Your Possessions Need Insurance—and So Does Your Condo.

Stuff happens.. Whether damage from weight of sleet, smoke, or other causes, State Farm has fantastic options to help you protect your condo and personal property inside against unexpected circumstances.

Townhome owners of Colorado Springs, State Farm has you covered.

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Christopher Smith is ready to help you handle the unexpected with dependable coverage for all your condo insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Christopher Smith can help you submit your claim. Keep your condo sweet condo with State Farm!

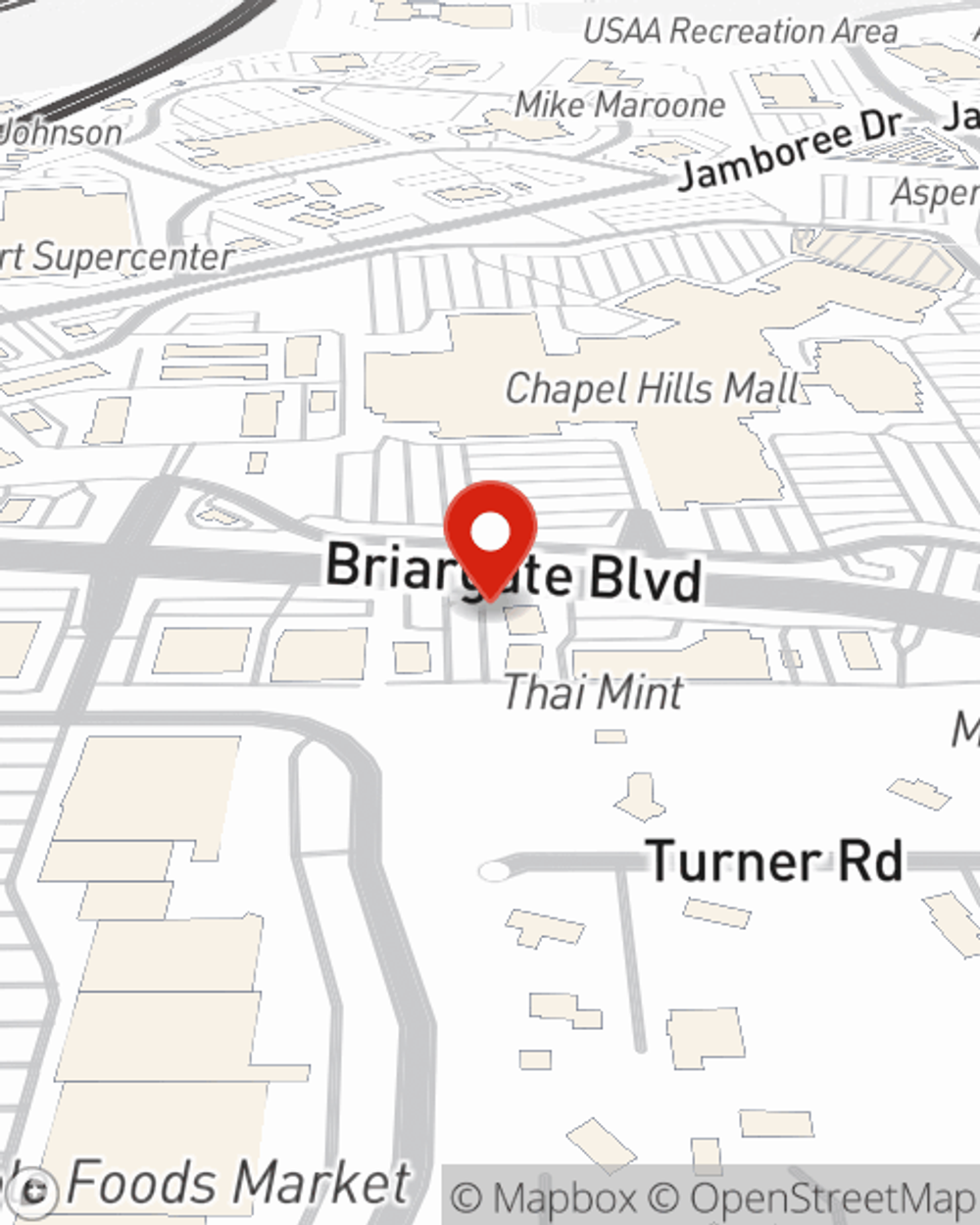

Reach out to State Farm Agent Christopher Smith today to learn more about how one of the well known names for condo unitowners insurance can help protect your condominium here in Colorado Springs, CO.

Have More Questions About Condo Unitowners Insurance?

Call Christopher at (719) 344-2420 or visit our FAQ page.

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Christopher Smith

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.