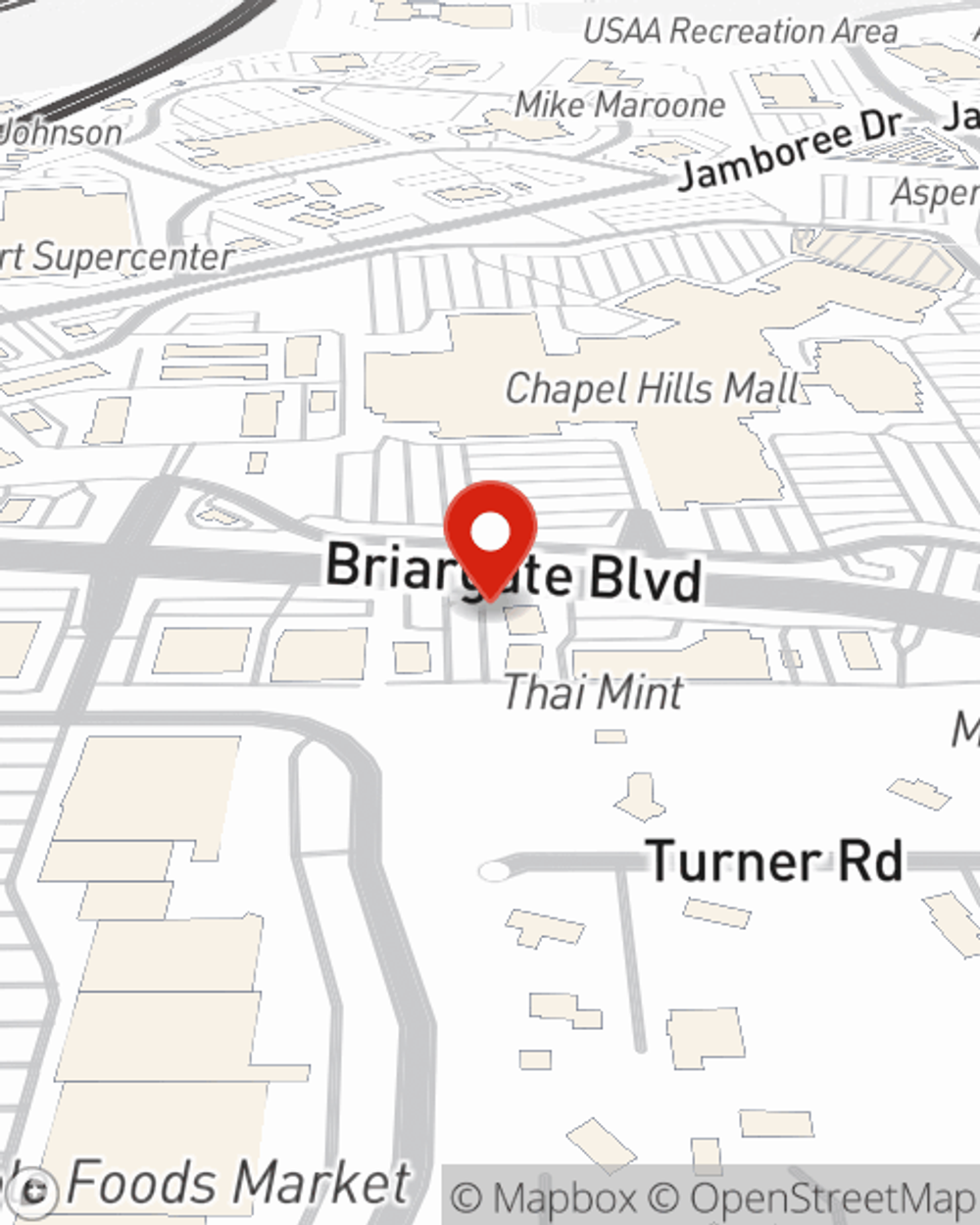

Life Insurance in and around Colorado Springs

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Christopher Smith about life insurance. That's because once you buy a home or condo, you'll want to be ready if the worst happens.

Coverage for your loved ones' sake

What are you waiting for?

Colorado Springs Chooses Life Insurance From State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years coverage for a specific time frame or another coverage option, State Farm agent Christopher Smith can help you with a policy that can help cover your loved ones.

If you're a person, life insurance is for you. Agent Christopher Smith would love to help you check out the variety of coverage options that State Farm offers and help you get a policy that's right for you and your children. Reach out to Christopher Smith's office to get started.

Have More Questions About Life Insurance?

Call Christopher at (719) 344-2420 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Christopher Smith

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.